Black Business Community Development Corporation (BBCDC)

MISSION

As a Community Development Corporation, BBCDC works to create economic impact in underserved minority communities through investing in the development of affordable housing, Incubators, makerspaces, co-working spaces and other community facilities.

About BBCDC

BBCDC is the charitable affiliate of BBIF. Established in 1993, the previous name of BBCDC was Black Business Capital Financing Corporation (BBCFC). In early 2020 the BBCFC board felt it was necessary to transition to a CDC, hence changing the name to BBCDC. The new name (BBCDC) became effective 3/16/2020.

History of BBCDC

Created in 1993, BBCDC partners with local and state business development organizations, chambers, banks, governmental agencies, educational institutions, and other groups to provide information and resources to our target market clients. BBCDC is a 501c3 entity that provides fundraising, education, and networking opportunities to develop and support the growth of minority businesses and underserved communities. Additionally, BBCDC has the vision to develop sustainable communities by providing low to moderate and affordable housing.

BBCDC vs. BBIF

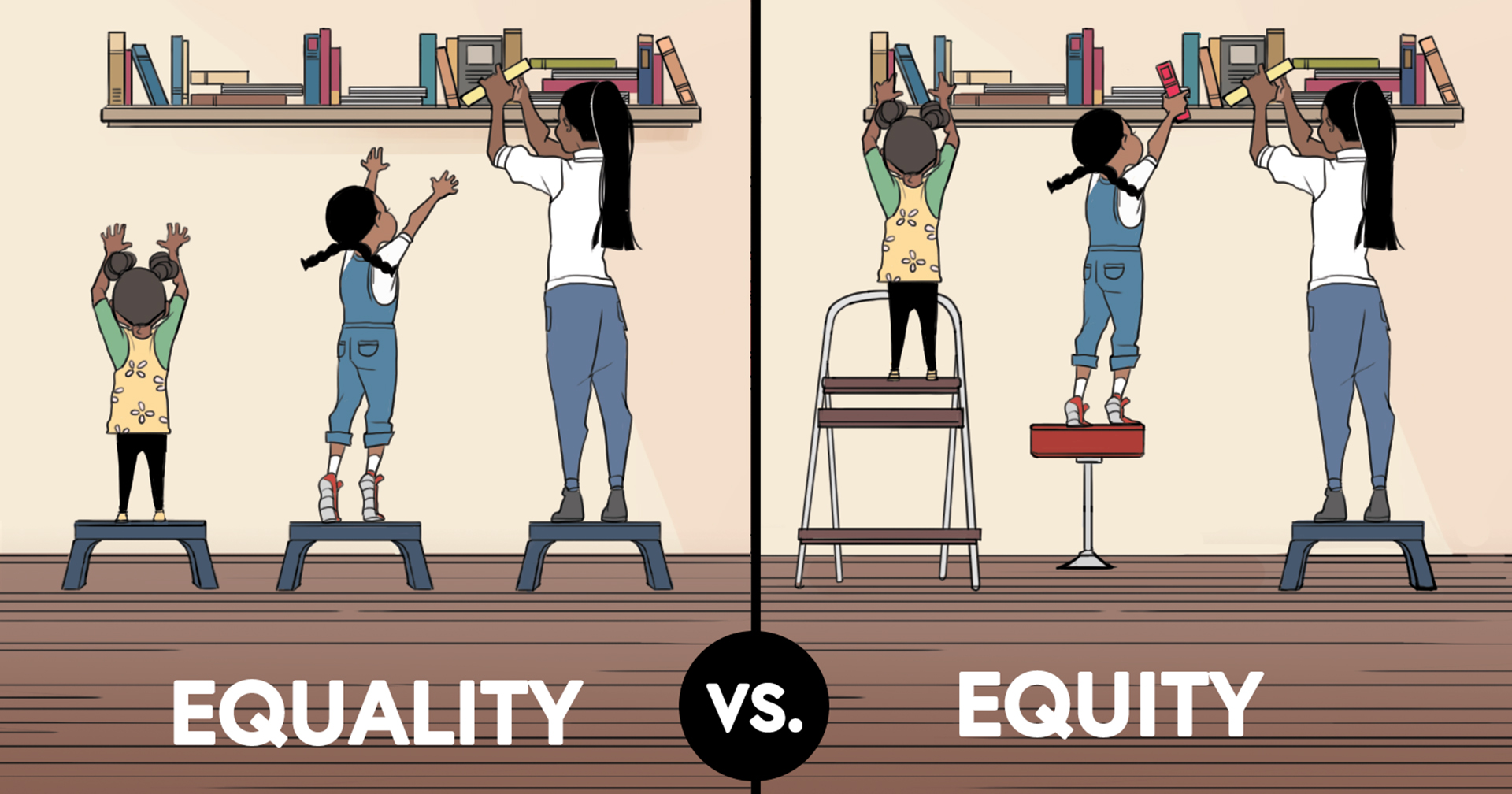

How BBCDC & BBIF work together to help close the wealth gap

BBCDC: Charitable Affiliate Fundraising Entity 501(c)(3)

The Black Business Community Development Corporation (BBCDC) was created in 1993. It is a 501c3 entity that provides fundraising, education, and networking opportunities to develop and support the growth of minority businesses and underserved communities. Additionally, BBCDC has the vision to develop sustainable communities by providing low to moderate and affordable housing. The previous name of BBCDC was Black Business Capital Financing Corporation (BBCFC). In early 2020 the BBCFC board felt it was necessary to transition to a CDC, hence changing the name to BBCDC. The new name, BBCDC, became effective March 1, 2020.

BBIF: CDFI Financial Institution; Direct Lender CDFI 501(c)(4)

Black Business Investment Fund, Inc. (BBIF) was established in 1987. The organization was created through the Florida Small Minority Business Act and later through Florida statute. BBIF Florida is certified by the U.S. Department of the Treasury’s CDFI Fund as a Community Development Financial Institution (CDFI) and Community Development Enterprise (CDE). The organization has received $93.49 million in New Market Tax Credit allocations since 2014.

A statewide entity, BBIF’s headquarters is in Orlando with regional offices in South Florida (Miami Gardens) and North Florida (Jacksonville). It is our overarching goal to help minority and underserved businesses by providing loan capital alongside specialized financial business development training. We also work to stabilize low-income, distressed neighborhoods by investing in economic development projects that create jobs.

Our Board

Susan Brosch, Board Chair

Susan Brosch has over 30 years of experience providing business development services to small, minority and disadvantaged businesses. She was the Minority Business Enterprise (MBE) Coordinator for the Florida Department of Management Services, Division of Building Construction from 1990 to 1992. Thereafter, she moved to the State’s Minority Business Advocacy and Assistance Office and performed as the MBE Contract Compliance Officer, Certification Officer and Office Automation Specialist.

Kimberly Robinson, Board Vice Chair

Kimberly Robinson brings over 20 years of experience in entrepreneurship and real estate investing and hold a Broker Associate position with Dover International Company, Inc. She has been licensed in real estate since 2005 and focuses on sales and leasing of commercial, residential, and investment real estate. Ms. Robinson attained the Certified Commercial Investment Member (CCIM) real estate designation in 2010.

Fozia Andarge, Treasurer/ Secretary

Fozia is the founder of FM Financial Services, Inc. She began her career as a stockbroker and Registered Representative. In 1992, she decided to start her own company and began offering full-service consulting business, providing accounting, financial planning and business development services.

Lawrence Chukwu, Board Member

Mr. Chukwu has over 25 years of diversified experience in environmental site assessments, environmental engineering (conceptual/engineering remedial designs and implementation) of soil and groundwater remediation technologies, geotechnical investigations, construction engineering inspections and management for transportation, Emergency Response for disaster relief for public assistance emergency response/recovery program delivery management (PDMG), provided Federal Grants for debris removal, emergency protective measures, roads/bridges repairs and replacement, schools, hospitals, airports, city seawall, embarkments, public buildings, pump stations & water treatment facilities, support services during Hurricanes Charley, Frances and Jeanne, Irma, Floods/Snow Storms in Indiana and Nebraska for the Federal Emergency Management Agency (FEMA).